Key Takeaways Summary

- Quantifiable Impact: Successful financial analyst resumes must quantify achievements using specific metrics like ROI, budget savings, or percentage of growth (e.g., “Increased portfolio efficiency by 15%”).

- Technical Proficiency: Highlight essential tools such as Excel (VBA, Macros), SQL, Python, Tableau, and ERP systems like SAP or Oracle to pass ATS filters.

- Certification Emphasis: Prominently display designations like CFA, CPA, or MBA, as these are critical differentiators in the competitive finance sector.

- ATS Optimization: Use standard headings and specific keywords found in the job description to ensure your resume is readable by Applicant Tracking Systems.

- Tailored Structure: Adapt your resume structure based on your experience level—entry-level candidates should focus on education and skills, while seniors should emphasize leadership and complex modeling.

- Clear Formatting: Maintain a clean, professional layout with consistent fonts and bullet points to reflect the precision required in a financial analyst role.

Introduction

In the high-stakes world of finance, precision is everything. Your financial analyst resume acts as your first balance sheet, demonstrating your professional assets and potential return on investment to a hiring manager. Whether you are targeting FP&A, investment banking, or corporate treasury, the competition is fierce, and generic templates simply won’t cut it in 2026.

To land an interview at a top-tier firm, your resume needs to do more than list job duties; it must tell a compelling story of financial stewardship and data-driven decision-making. Here is what makes a finance resume stand out:

1. Data-Driven Achievements: Employers want to see numbers. Instead of saying “managed budget,” say “oversaw a $5M quarterly budget and reduced variances by 12%.”

2. Proficiency in Modern Tech Stack: The modern financial analyst is part data scientist. Showcasing skills in SQL, Python, and Power BI is just as important as knowing GAAP principles.

3. Strategic Insight: You must demonstrate not just that you can crunch numbers, but that you can interpret them to drive business strategy. Your bullet points should reflect analysis that led to actionable business improvements.

Julian Weber

Senior Financial Analyst • New York, NY

Email: julian.weber.finance@gmail.com •

Phone: (212) 555-0199 • LinkedIn: /in/julianweber

Profile

CFA Level II Candidate and detail-oriented Financial Analyst with 6+ years of experience in corporate finance and investment analysis. Proven record of improving forecast accuracy by 20% and identifying cost-saving opportunities totaling $1.2M annually. Advanced expertise in financial modeling, SQL, Python, and data visualization tools.

Experience

Senior Financial Analyst – Apex Capital Solutions, New York, NY (2021–Present)

• Built complex financial models supporting a $500M portfolio, increasing ROI by 15%

• Led quarterly budgeting with 5 department heads, reducing variance by 10% YoY

• Automated reporting using Python and SQL, saving 20+ hours per month

Financial Analyst – BrightHorizons Logistics, Boston, MA (2018–2021)

• Analyzed P&L statements and operational KPIs to guide executive decisions

• Supported due diligence for a $20M acquisition through valuation and risk analysis

• Developed Tableau dashboards to improve cash flow visibility and liquidity planning

Education

Bachelor of Science in Finance

New York University, Stern School of Business (2014–2018)

Magna Cum Laude • Finance Club President

Skills

Financial Modeling (DCF, 3-Statement) • Forecasting & Budgeting • Advanced Excel (VBA, Macros) • SQL & Python • Tableau & Power BI • SAP & Oracle ERP • GAAP & IFRS • Risk Management

Certifications

CFA Level II Candidate – CFA Institute

Financial Modeling & Valuation Analyst (FMVA) – CFI

function copyResumeFA() { const text = `Julian Weber Senior Financial Analyst • New York, NY Email: julian.weber.finance@gmail.com | Phone: (212) 555-0199 PROFILE —————————————- CFA Level II Candidate with 6+ years of experience in corporate finance and investment analysis. Improved forecast accuracy by 20% and identified $1.2M in annual cost savings. Expert in financial modeling, SQL, Python, and data visualization. EXPERIENCE —————————————- Senior Financial Analyst – Apex Capital Solutions (2021–Present) • Built models for a $500M portfolio, increasing ROI by 15% • Led budgeting with 5 departments, reducing variance by 10% • Automated reports using Python and SQL Financial Analyst – BrightHorizons Logistics (2018–2021) • Analyzed P&L and operational KPIs • Supported $20M acquisition due diligence • Built Tableau dashboards for cash flow analysis EDUCATION —————————————- B.S. in Finance – NYU Stern School of Business (2014–2018) Magna Cum Laude SKILLS —————————————- Financial Modeling Forecasting & Budgeting Advanced Excel (VBA) SQL & Python Tableau / Power BI SAP / Oracle GAAP / IFRS CERTIFICATIONS —————————————- CFA Level II Candidate FMVA – CFI`; navigator.clipboard.writeText(text).then(() => { const s = document.getElementById(“copyStatus”); s.style.display = “inline”; setTimeout(() => s.style.display = “none”, 1800); }); }

Structuring a Winning Financial Analyst Resume

Creating a high-impact financial analyst resume requires a structure that highlights your analytical prowess and technical skills immediately. Recruiters in the finance sector often spend less than 10 seconds scanning a resume before deciding whether to proceed. To survive this initial cull and beat the automated systems, you need a layout that is both logical and content-rich.

Your resume should typically follow a reverse-chronological format, as this is the standard expectation in the industry. This format prioritizes your most recent and relevant work experience. However, the specific sections you include and how you arrange them can make a significant difference. For example, if you have strong technical skills in Python or SQL, moving your skills section higher up can be advantageous.

For more insights on layout strategies, check out our guide on how to make your resume stand out and beat ATS.

1. The Header and Contact Information

Keep this section clean and professional. Include your full name, phone number, professional email address (avoid nicknames), and a link to your LinkedIn profile. If you have a portfolio showing financial models or GitHub repositories for code, include those links as well. Ensure your LinkedIn profile matches the information on your resume exactly.

2. Professional Summary

A strong professional summary is your elevator pitch. It should be 3-4 lines that encapsulate your years of experience, key industries, and biggest achievements. Avoid generic statements like “hard-working individual looking for a job.” Instead, focus on specific value.

Example: “Detail-oriented Financial Analyst with 4 years of experience in the retail sector. Skilled in building dynamic financial models in Excel and analyzing large datasets using SQL. successfully identified cost variances saving the company $200k in FY2023.”

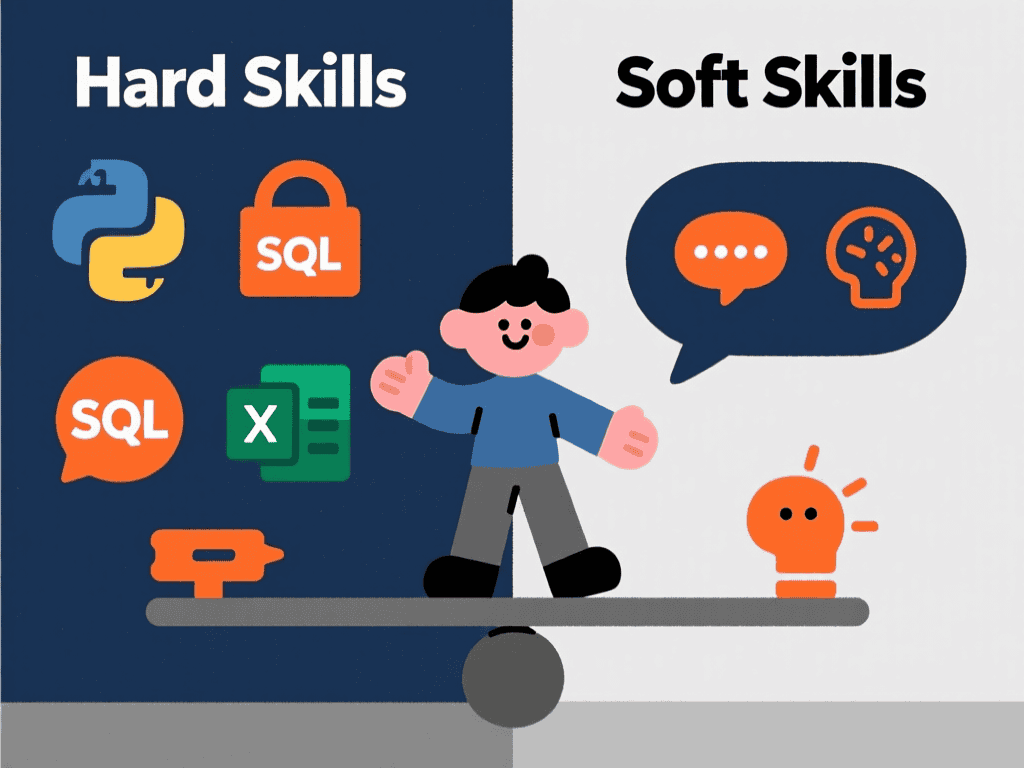

Key Skills for Financial Analysts in 2026

The skill set required for financial analysts is evolving. While Excel remains king, the ability to handle big data and automate processes is increasingly valued. Your skills section should be divided into “Hard Skills” (Technical) and “Soft Skills” (Interpersonal).

Employers are specifically looking for a mix of traditional accounting knowledge and modern data analytics. If you are unsure which skills are currently trending, review our article on best skills to put on a resume in 2026.

Technical Skills (Hard Skills)

- Financial Modeling: DCF, LBO, M&A models, 3-statement models.

- Data Analysis: SQL, Python (Pandas, NumPy), R.

- Excel Mastery: VLOOKUP, XLOOKUP, Index/Match, Macros/VBA, Pivot Tables.

- BI Tools: Tableau, Power BI, QlikView.

- ERP Systems: SAP, Oracle NetSuite, Hyperion, Microsoft Dynamics.

- Accounting Standards: GAAP, IFRS, SOX Compliance.

Interpersonal Skills (Soft Skills)

- Communication: Translating complex financial data for non-financial stakeholders.

- Critical Thinking: Evaluating investment risks and opportunities.

- Attention to Detail: Ensuring accuracy in reporting and forecasting.

- Time Management: Handling month-end closes and tight deadlines.

For a broader list of essential abilities to highlight, refer to top resume skills employers want.

Crafting the Work Experience Section

The work experience section is the core of your resume. This is where you prove you can do the job. The biggest mistake candidates make is listing responsibilities instead of achievements. A responsibility is “Responsible for monthly reporting.” An achievement is “Streamlined monthly reporting process, reducing turnaround time by 3 days.”

Use the PAR (Problem, Action, Result) method to structure your bullet points. Start every bullet point with a strong action verb. If you are struggling to find the right words, our list of best words to describe yourself on a resume can help you find powerful alternatives to “managed” or “helped.”

Examples of Strong Bullet Points

- Weak: Created financial models for the team.

- Strong: Engineered robust 3-statement financial models to forecast revenue growth, directly supporting a strategic pivot that increased Q4 profits by 8%.

- Weak: Used Excel to look at data.

- Strong: leveraged Advanced Excel and VBA to automate the reconciliation of over 5,000 transaction records monthly, achieving 99.9% accuracy.

- Weak: Worked with the sales team on budgets.

- Strong: Partnered with regional sales directors to develop annual operating budgets of $15M, identifying specific areas to cut variable costs by 5%.

If you are moving from a related field like accounting, make sure to frame your experience analytically. You can compare your approach with our Best Accountant Resume in 2026 examples to see the nuances between the two roles.

Education and Certifications

In finance, credentials carry significant weight. The education section should list your university, degree, graduation date, and relevant honors (like Cum Laude). If you are a recent graduate, including your GPA is acceptable if it is above 3.5. Otherwise, leave it off.

The Power of Certifications

Certifications indicate a commitment to the profession and a high level of expertise. If you are pursuing a CFA, CPA, CMA, or MBA, list these prominently. Even if you are only a “Candidate,” list it. For example, “CFA Level II Candidate” shows you have already passed a rigorous Level I exam.

Common certifications to include:

- CFA (Chartered Financial Analyst): The gold standard for investment analysis.

- CPA (Certified Public Accountant): Highly valued for corporate finance and controllership roles.

- CMA (Certified Management Accountant): excellent for FP&A roles.

- FMVA (Financial Modeling & Valuation Analyst): Demonstrates practical modeling skills.

Handling Lack of Experience

Everyone starts somewhere. If you are applying for an entry-level financial analyst position, your resume needs to lean heavily on your education, internships, and academic projects. Did you manage a virtual portfolio in a university club? Did you write a thesis on market trends? These count as experience.

Focus on transferable skills. If you worked in retail, did you cash up the tills or analyze sales trends? Frame it relevantly. For a comprehensive guide on this, read How to Write a Resume with No Experience.

ATS Optimization Strategies

Most large companies use Applicant Tracking Systems (ATS) to filter resumes before a human ever sees them. If your resume is not optimized, it will be rejected automatically. To beat the ATS, you must use relevant keywords found in the job description.

Common ATS keywords for financial analysts include: Variance Analysis, ROI, P&L Management, Financial Reporting, GAAP, Forecasting, Budgeting, and specific software names like Bloomberg Terminal or Hyperion.

Avoid using graphics, charts, or columns that ATS parsers cannot read. Stick to standard headings. For a deep dive into technical optimization, refer to our article on ATS Resume Optimization (2026).

Common Mistakes to Avoid

Even qualified candidates get rejected due to avoidable errors. Here are the most common pitfalls for financial analyst resumes:

1. Being too vague: “Managed accounts” tells the recruiter nothing. Be specific about the size and scope.

2. Ignoring the cover letter: While some say cover letters are dead, in finance, they are often a test of your business writing skills.

3. Typos in numbers: A typo in a word is bad; a typo in a number is fatal for a financial analyst. Double-check every figure.

4. Overloading with jargon: Use industry terms, but ensure the resume is readable. Don’t make it a “word salad” of buzzwords.

For a full checklist of errors to scrub from your document, see Master Your Job Search: Resume Errors and Fixes for 2026.

Formatting: Length and Layout

How long should your resume be? For most professionals with under 10 years of experience, a one-page resume is the standard. It forces you to be concise and prioritize your most impactful achievements. If you have extensive experience (10+ years) or a long list of publications/projects, two pages are acceptable.

If you are struggling to fit everything on one page, or want to know the rules for longer formats, check out our guide on Two-Page Resume Mastery.

Additionally, keep in mind that different roles have different expectations. For instance, a Data Analyst Resume might focus more on coding languages, while a Business Analyst Resume might focus more on process improvement and stakeholder management. Ensure you are tailoring your resume to the specific flavor of “analyst” you are applying for.

FAQ: Financial Analyst Resume

1. Should I include a photo on my financial analyst resume?

In the US, UK, and Canada, no. It is not standard practice and can lead to bias issues. However, in some European or Asian markets, it may be expected. Always check local norms.

2. Do I need a CFA to be a financial analyst?

No, but it helps. A CFA is highly respected for investment roles (buy-side/sell-side). For corporate finance (FP&A), a CPA or MBA might be more valuable. However, demonstrated skills in modeling and analysis are often enough for entry-to-mid-level roles.

3. How do I show I am good at Excel without just listing “Excel”?

Mention specific functions or projects in your bullet points. For example: “Built an automated dashboard using VBA macros to track daily liquidity positions.” This proves your skill level is advanced.

4. What is the difference between a resume and a CV for finance jobs?

In the US, they are often used interchangeably, but a “Resume” is typically a 1-page summary, while a “CV” is a longer academic document. If applying internationally, the terminology matters. Learn more about the differences in our article Is A CV The Same As A Resume In Australia (and other regions).

5. How important is the “Interests” section?

In finance, specifically investment banking, the interests section can actually be a conversation starter during interviews. Unique interests (e.g., “Competitive Chess,” “Marathon Runner”) show discipline and personality, but keep it brief.

Author Information

Rebecca Lawson – Lead Resume & ATS Specialist

Rebecca Lawson is the Lead Resume & ATS Specialist at ResumeAITools, with 10+ years of experience helping job seekers across all industries improve their resumes and land better roles. With a Fortune 500 HR background, she understands exactly how ATS systems filter applicants and what hiring managers look for in the finance sector. She specializes in translating complex financial experience into compelling, interview-winning narratives.